Key Highlights

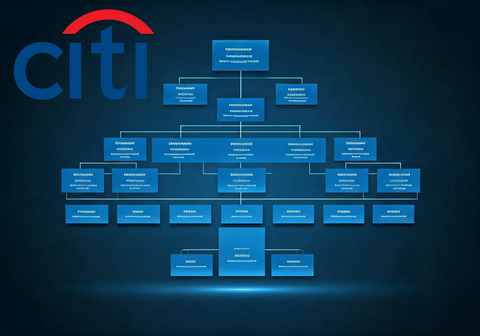

- Citigroup has a new setup that focuses on a simpler structure. This change helps business leaders talk directly with the CEO.

- This update makes decision-making faster and aims to improve how they serve clients.

- A new Client organization shows that Citigroup wants to strengthen client connections around the world.

- The restructuring combines leadership roles outside North America for a more united approach.

- This plan is to strengthen Citigroup as a top banking partner for institutions, a leader in wealth management globally, and a valued personal bank in the United States.

Introduction

Citigroup is based in busy New York City, in the state of New York. It is a major player in financial services alongside Bank of America. The company was formed from the merger of Citicorp and Travelers Group. This huge bank operates all over the world. Knowing how Citigroup is organized helps us understand how it works.

Understanding the Hierarchical Structure of Citigroup

- Citigroup historically used a traditional structure.

- This structure has a top-down style.

- Decisions go from the CEO to different management levels.

- They then reach employees in their divisions.

- This method makes the chain of command clear.

- However, it can slow down decision-making because of many layers.

- To fix this, Citigroup has made its structure flatter.

- By cutting down management layers, they want to empower lower-level workers.

- This helps the company be more agile.

- It allows for quick responses to changing market conditions.

- This change shows Citigroup is evolving.

- They are adapting to meet the needs of the financial landscape.

The Role of Top Management and Their Impact on Operations

At Citigroup, the Chief Executive Officer (CEO) is Jane Fraser, an alumna of Harvard Business School. She guides the company’s plans and goals, continuously striving to make Citigroup the preeminent banking partner for its clients. Her choices greatly affect how well the company does and how it reacts to the management’s current expectations.

The CEO works side by side with the executive team. This team includes the Chief Financial Officer (CFO), the Chief Operating Officer (COO), and heads of different divisions. Each person on the team has special skills. Together, they make important choices about investments, managing risks, and business strategies.

Top management's skill is key to Citigroup's success. Their ability to spot market trends and make smart decisions affects how competitive the company is in the global financial market. The leadership style of the CEO and top management shapes the whole organization. This influences employee morale, customer happiness, and in the end, the company’s profits.

How Citigroup's Traditional Structure Supports Its Global Reach

Citigroup is moving to a flatter structure. However, its old hierarchical model still helps its global operations. This clear chain of command helps the company to apply the same policies and procedures across its many branches worldwide.

The Institutional Clients Group management layers at Citigroup uses this structure to serve its clients in different areas. By keeping some standard practices but also allowing room for local adjustments, the company makes sure that its clients receive a steady level of service no matter where they are.

Citigroup's Global Consumer Bank also plays a big part in its worldwide reach. The traditional structure helps to manage various banking products and services. It makes sure that customers around the world have a consistent brand experience. This balance between central control and local flexibility has helped Citigroup stand out in the international finance market.

Exploring Citigroup's Divisional Breakdown

Citigroup has two main parts in its operations. These are the Institutional Clients Group (ICG) and the Global Consumer Bank (GCB). This setup helps the company serve a wide range of clients. They work with big businesses, governments, and everyday people.

With this structure, Citigroup can use its expert knowledge in each area. Teams are organized to meet the specific needs and requests of their clients. This helps them create and deliver focused products and services.

Institutional Clients Group (ICG): Services and Significance

The Institutional Clients Group (ICG) at Citigroup provides many financial products and services to institutional clients around the world. This shows that Citigroup is a global leader in financial services. ICG focuses a lot on giving excellent client service. It is important to Citigroup's work. The management team in ICG helps carry out Citigroup's plans for its institutional clients. This shows how important this group is to the whole organization.

Global Consumer Banking (GCB): A Deep Dive into Consumer Services

Global Consumer Banking (GCB) at Citigroup aims to provide a wide range of financial products and services to customers all over the world. They are dedicated to offering excellent client service, making them a top banking partner. Under Citi CEO Jane Fraser's leadership, GCB works hard to maintain Citigroup’s status as a global leader in consumer banking. They focus on giving innovative solutions that meet the different needs of clients in many markets.

Citigroup's Geographic Strategy and Regional Divisions

Citigroup's strategy focuses on having a strong presence worldwide, while also understanding local markets well. The bank offers a broad range of financial products and splits its work into important regions to show its promise to serve clients around the globe.

This plan helps Citigroup tailor its services to fit the unique needs of each area, as part of Citi's broader strategy. It also aids the company in reducing risks by spreading its investments and taking advantage of growth chances in various parts of the world.

Key Markets and Regional Operations: A Global Perspective

Citigroup focuses on important markets that have great growth potential. These markets are the United States, where the headquarters is in New York, and other key places like Hong Kong.

By putting resources into these areas, Citigroup can benefit from their strong financial systems and find skilled workers. This helps the company create financial products and services that fit the needs of these changing markets.

Citigroup's regional teams work closely with the headquarters. They do this to keep a strong global brand while also following local laws and conditions. This plan helps the company achieve its global goals while being aware of local differences.

The Importance of Local Teams in Citigroup's Global Success

Citigroup knows that having a strong global brand is important. However, it also sees how vital local teams are for overall success. Local teams understand what their markets need and want. This local knowledge helps Citigroup provide products and services that fit customers' needs.

When Citigroup supports local teams, it can adapt to changes in the market quickly. This flexibility is essential in today’s fast-changing financial world. It helps Citigroup stay ahead and meet what customers expect.

Citigroup works in many countries. It depends on its regional teams to manage smooth international transactions. They help meet the needs of a variety of clients. The company can succeed in handling different rules, cultures, and market situations. This success is largely due to the valuable knowledge and insights from these existing regional layers.

Centralized Corporate Functions at Citigroup

Citigroup depends a lot on its central corporate functions to keep its global activities running well. These functions help different divisions by offering support and oversight, which boosts the company's overall efficiency and stability.

By using this central method, Citigroup can make important processes easier and keep consistent standards everywhere. When it combines functions like finance, risk management, and legal matters, the company builds a strong framework for its operations. This helps maintain its brand reputation and gain the trust of its stakeholders.

Finance and Risk Management: Backbone of Citigroup's Stability

Central to Citigroup's work are its finance and risk management teams. As a bank in a tightly controlled industry, strong risk management is very important to protect its money and brand.

The Comprehensive Capital Analysis and Review (CCAR) is a rule set by the Federal Reserve. It helps keep banks strong and secure. Citigroup joins in the CCAR process and follows strict stress tests. These tests check if the bank can handle tough economic situations.

Citigroup aims to reduce financial risks by doing careful risk checks, keeping good internal controls, and following rules set by the office of the comptroller of the currency. These actions are key to keeping a steady financial state. They also help build trust with investors, clients, and regulators. This trust helps keep the company's future strong.

Technology's Role in Supporting Citigroup's Global Operations

In today's digital age, technology plays a critical role in supporting Citigroup's global operations on behalf of Citigroup. The company leverages cutting-edge technological solutions to enhance efficiency, improve customer experience, and strengthen risk management protocols.

|

Area |

Technology's Impact |

|

Customer Service |

Mobile banking apps, online platforms, and personalized digital experiences enhance customer convenience and accessibility to banking services. |

|

Risk Management |

Data analytics, artificial intelligence, and machine learning algorithms help identify potential risks, detect fraudulent activities, and ensure regulatory compliance. |

|

Global Operations |

Secure communication networks, cloud computing, and data centers facilitate seamless collaboration and data sharing across Citigroup's global offices, supporting real-time decision-making and efficient transaction processing. |

By continually investing in technology and fostering a culture of innovation, Citigroup aims to remain at the forefront of the digital transformation within the financial services industry. This commitment to technological advancement is not just a strategic choice but a necessity in today's interconnected world.

Conclusion

In conclusion, looking at Citigroup's organization helps us understand how it operates worldwide. Its clear structure, divided teams, and regional plans show how the leaders work together with local groups for success. Key functions like finance, risk management, and technology are important for keeping Citigroup stable and innovative. Knowing how these parts fit together helps us see how Citigroup handles different markets and stays a leader in its field. For more detailed information about corporate structures, feel free to contact our business experts. Discover the details of Citigroup's organizational strength to gain a better view of global finance.

Frequently Asked Questions

Does the Databahn Research Team offer a more detailed and comprehensive deep dive Citigroup Company Profile and Org Chart Report?

Yes, the Databahn Research Team track and report on Citigroup with the most comprehensive and detailed deep dive report in the global marketplace. The Citigroup Company Profile and Org Chart Report is updated and refreshed on a quarterly basis and the Databahn research team also offer custom services to research your specific focus areas within the Citigroup organization. Go here to purchase and download the deep dive Citigroup Company Profile and Org Chart Report now.

What Are the Primary Divisions Within Citigroup?

Citigroup has two main divisions. The first is the Institutional Clients Group (ICG), which works with other institutions. The second is the Global Consumer Bank (GCB), which focuses on individual consumers. Both divisions get support from corporate functions that are managed by important leaders, including the Chief Legal Officer and the President of Citi.

How Does Citigroup's Hierarchical Structure Influence Its Operations?

Citigroup has been organized in a hierarchy for years. Now, it is working to have a flatter structure. This change is meant to help make decisions faster. It will help with the execution of Citi’s plans and improve the company’s ability to offer excellent client service.

Can You Explain Citigroup's Approach to Global and Regional Markets?

Citigroup combines a wide global presence with local knowledge. They keep a strong global brand, but local teams, led by the Global Head of Strategy, focus on local details. This method is important for working in different markets and cultures. It also helps with foreign relations, especially in citi’s consumer businesses.

What Role Do Centralized Corporate Functions Play at Citigroup?

Centralized functions at Citigroup, led by the Chief Executive Officer, are very important. They offer key support and make sure practices are the same across the board. They also manage important areas such as finance and risk. These functions play a big role in handling a variety of factors. They help the new executive management team by keeping global operations running smoothly.