DICK's Sporting Goods Org Chart & Sales Intelligence Blog

DICK'S Sporting Goods, Inc.

345 Court Street

Coraopolis, PA 15108

United States

Main Phone: (724) 273-3400

Website: https://www.dickssportinggoods.com

Ticker Symbol: (NYSE: DKS)

Sector(s): Consumer Cyclical

Industry: Specialty Retail

Full Time Employees: 17,800

Youtube | Twitter | Facebook | Pinterest | Instagram

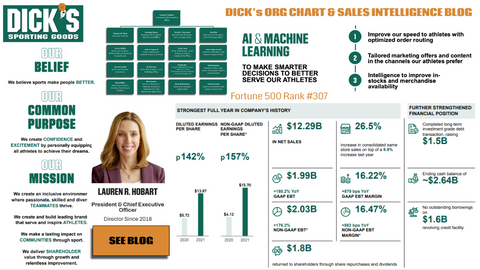

Dick’s Sporting Goods Fortune 500 Rank: #307

Where are Dick’s Sporting Goods stores located?

What do the Dick’s Sporting Goods Org Charts look like?

PREVIEW

Who are the decision makers at Dick’s Sporting Goods?

|

Edward W. Stack Executive Chairman Lauren R. Hobart President & Chief Executive Officer Navdeep Gupta Executive Vice President, Chief Financial Officer Donald J. Germano Executive Vice President, Stores & Supply Chain Vlad Rak Executive Vice President, Chief Technology Officer Vincent Corno Senior Vice President, Real Estate & Construction Carrie Guffey Senior Vice President, Softlines Merchandising and Vertical Brands John E. Hayes III Senior Vice President, General Counsel & Secretary Peter Land Senior Vice President, Chief Communications & Sustainability Officer |

Julie Lodge-Jarrett Senior Vice President, Chief People & Purpose Officer Steve Miller Senior Vice President, Strategy, eCommerce & Analytics Joe Pietropola Senior Vice President, eCommerce Ed Plummer Senior Vice President, Chief Marketing Officer Toni Roeller Senior Vice President, In-Store Environment, Visual Merchandising & House of Sport at DICK’S Sporting Goods Todd Spaletto President, Public Lands, Senior Vice President, DICK'S Sporting Goods Will Swisher Senior Vice President, Planning, Allocation & Replenishment and Merchandising Hardlines Sean Whitehouse Senior Vice President, Supply Chain |

Who serves on Dick’s Sporting Good’s Board of Directors?

|

Edward W. Stack Executive Chairman of DICK’S Sporting Goods, Inc. William J. Colombo Vice Chairman of DICK’S Sporting Goods, Inc. Mark J. Barrenechea Chief Executive Officer and Chief Technology Officer of OpenText Corp. Emanuel Chirico Chairman and Retired Chief Executive Officer of PVH Corp. Anne Fink President, Global Foodservice, PepsiCo, Inc. Larry Fitzgerald, Jr. Professional Athlete, National Football League |

Lauren R. Hobart President & Chief Executive Officer, DICK’S Sporting Goods, Inc. Sandeep Mathrani Executive Chairman and Chief Executive Officer, WeWork Desiree Ralls-Morrison Executive Vice President, General Counsel and Corporate Secretary, McDonald’s Corporation Lawrence J. Schorr Retired Chief Executive Officer of Simona America Group, Simona AG Larry D. Stone Retired President and Chief Operating Officer of Lowe's Companies Inc. |

Where is Dick’s Sporting Goods investing in their business?

PREVIEW

Dick’s Sporting Goods Expands Same-Day Delivery With DoorDash Partnership

Sept 2022

Dick’s Sporting Goods is partnering with DoorDash to expand same-day delivery options. More than 250,000 items will be available through the partnership. Dick’s has partnered with Instacart for same-day delivery since 2020. Dick’s Sporting Goods has partnered with DoorDash to allow consumers in 47 states to order more than 250,000 items from Dick’s Sporting Goods through the DoorDash app, including athletic equipment, team apparel and seasonal goods. “We are thrilled to partner with DoorDash and become the platform’s first sporting goods and apparel retailer to offer same-day delivery,” said Scott Casciato, Dick’s Sporting Goods’vice president of omnichannel fulfillment and athlete service.

Source

Dick’s attacks cart abandonment with predictive AI

Aug 2022

Dick’s Sporting Goods Inc. is dynamically targeting individual online shopper needs in real time. The nation’s largest sporting goods retailer is deploying artificial intelligence (AI)-based software from Metrical to reduce cart abandonment by applying deep, real-time data to determine what will prompt a customer to stay with their purchase. AI is a cornerstone of Dick’s online strategy, because of the technology’s ability to focus on the motivations of individual shoppers, while providing actionable insights and analytics.

“Cart abandonment was a key strategic area for us to optimize at Dick’s Sporting Goods,” explained Miche Dwenger, VP e-commerce experience at Dick’s. “We tried both third party and in-house-developed solutions, but none delivered the results we wanted because they lacked a predictive capability. Metrical’s predictive AI engine not only improved cart conversions, but its ability to dynamically present personalized content including messages, offers, and other relevant information has enabled us to dramatically improve the customer experience.”

Source

Dick’s Sporting Goods offers accelerated payments to boost supplier diversity

Aug 2022

Dick’s aims to build relationships with diverse suppliers by providing minority-owned businesses access to working capital. Offering early payment programs to suppliers can help reduce financial strain. But for diverse-owned businesses that often face difficulty accessing credit, early payment plans can bridge a crucial financial gap. The existing financial system has “systemic biases attached to the underwriting process,” which fuel underrepresentation and underfunding, C2FO VP of Client Success Jeremy Colwell said in an email. Black-owned firms are 7% less likely to be approved for financing at banks overall compared to white-owned firms, a 2019 Federal Reserve report found. “One of the challenges that diverse-owned and operated businesses face is access to working capital,” Ramon Catania, director of supplier initiatives for DICK's, said in the release. “With C2FO, suppliers who work with us will have access to cash sooner to fund their day-to-day operations or expand their business.”

Source

What are Dick’s Sporting Goods executives saying about business performance?

DICK'S Sporting Goods, Inc. (DKS) Q2 2022 Earnings Call Highlights

August 23, 2022

Executives in Attendance

- Nate Gilch - SD, IR

- Lauren Hobart - President, CEO

- Navdeep Gupta - CFO

Comments from Lauren Hobart - President, CEO:

"We are very pleased with our second quarter results, which demonstrate the strength of our core strategies and the foundational improvements we've made across our business over the past 5 years. In fact, we delivered approximately the same EBT in Q2 as we did in all of fiscal 2019. While the macroeconomic environment remains uncertain, the DICK's Sporting Goods consumer has held up quite well. Over the past 2 years, they've made lasting lifestyle changes focused on health and fitness, sports and outdoor activities, and we remain uniquely positioned to capitalize on these secular trends."

"Now to our results. As we announced earlier this morning, we delivered second quarter sales of $3.1 billion. This included a comparable store sales decline of 5.1% and as expected, represented a sequential improvement from the first quarter. It's important to highlight that our sales continue to run substantially above pre-COVID levels, up 38% versus Q2 2019, reinforcing that the favorable shift in consumer behavior that I just mentioned is durable, and our actions to capitalize on this shift are yielding strong results."

"In addition, our digital experiences remain an integral part of our success, and we continue to prioritize investments in technology and in data science to elevate the athlete experience. We're focused on advancing our personalization capabilities and enhancing our one-to-one relationships with our athletes through our digital marketing, ensuring we serve them the most relevant products at the right time. Our personalization strategies are fueled by our robust and growing ScoreCard loyalty program and total athlete database. We now have over 25 million active ScoreCard loyalty members, a valuable cohort that has grown in recent years. And during the second quarter, our ScoreCard members generated well over 70% of our total sales, up approximately 200 basis points from the same period last year."

Comments from Navdeep Gupta - CFO:

“Let's begin with a brief review of our second quarter results. Consolidated sales decreased 5% to approximately $3.1 billion. When compared to 2019, sales increased 38%, demonstrating the sustainability of our structurally higher sales base compared to pre-COVID levels. Comparable store sales decreased 5.1% and, as expected, accelerated sequentially from the first quarter. As a reminder, we were lapping a 2-year stack comp increase of approximately 40% in Q2.”

“Transactions declined 8.4% while the average ticket increased 3.3%. Within our portfolio, each of our 3 primary categories of hardlines, apparel and footwear performed generally in line with our expectations.”

“Gross profit in the second quarter was $1.12 billion or 36.03% of net sales and declined 388 basis points versus last year. As expected, this decline was driven by merchandise margin rate decline of 197 basis points, higher supply chain costs and deleverage on fixed occupancy costs from lower sales. Compared to 2019, our merchandise margin rate expanded 439 basis points, driven by our increasingly differentiated product assortment, combined with our sophisticated and disciplined pricing strategies and favorable product mix. As Lauren mentioned, because of these structural drivers, we continue to expect our merchandise margin rate to be meaningfully higher than pre-COVID levels on an annual basis.”

Source

What do the Dick’s Sporting Goods financials look like?

|

Fiscal Year |

|

| Fiscal Year Ends | January 29, 2023 |

| Most Recent Quarter | July 29, 2022 |

|

Profitability |

|

| Profit Margin | 10.42% |

| Operating Margin | 14.45% |

|

Management Effectiveness |

|

| Return on Assets | 12.33% |

| Return on Equity | 47.95% |

|

Income Statement |

|

| Revenue | $11.91 Billion |

| Revenue Per Share | 151.14 |

| Quarterly Revenue Growth | -5.00% |

| Gross Profit | 4.71B |

| EBITDA | 2.05B |

| Net Income Avi to Common | 1.24B |

| Diluted EPS | 11.61 |

| Quarterly Earnings Growth | -35.70% |

|

Balance Sheet |

|

| Total Cash | 1.9B |

| Total Cash Per Share | 23.93 |

| Total Debt | 4.43B |

| Total Debt/Equity | 203.77 |

| Current Ratio | 1.83 |

| Book Value Per Share | 28.66 |

|

Cash Flow Statement |

|

| Operating Cash Flow | 687.84M |

| Levered Free Cash Flow | 317.11M |

What does the Dick’s Sporting Goods Technographic Data Profile look like?

Where is Dick’s Sporting Goods utilizing cloud technologies?

DATA SCIENTIST

Apply machine learning and data mining techniques to extract actionable insights from large-scale, high-dimensional data. Build and put into deployment algorithmic solutions that focus on improving the customer’s experience and driving value both in-store and on our website. Compile data from disparate data sources leveraging both qualitative and quantitative data to build models. Communicate complex analyses and models to all levels of leadership across the organization. Work with a variety of business units throughout the organization to help translate their requirements into specific model or research based deliverables. Continue to improve communication and collaboration patterns amongst the various analytics teams and business units. Research advancements in the field to discover new opportunities for development. Share findings and learning opportunities with fellow team members through mini-seminars and demonstrations.

Technologies in use: R, Python, SQL, Tensorflow, PyTorch, Google Cloud, AWS, Azure

DATA ANALYST – MARKETING

The Data Analyst – Marketing is responsible for the management, identification, creation, and implementation of targeted first party audience segments across multiple digital marketing distribution platforms including social, display, and video. The role serves as the main point of contact and subject matter expert on various marketing tools and capabilities including Adobe Real Time Customer Data Platform, LiveRamp (audience data and platform distribution) and Facebook, Instagram, Google, DV360, etc. (audience activation). The Data Analyst – Marketing leads conversations with both internal and external cross-functional partners focused on supporting the goals of upcoming digital campaigns through proper segment identification, generation and execution. The Data Analyst – Marketing oversees the daily digital audience process and regularly discuss approach strategies with leadership to ensure appropriate targeting segments are created and distributed and to apply segment performance metrics to inform and evolve future targeting strategies. Oversees the definition of audience segments based on collaboration with campaign, channel owners, and external media agency partners. Manages process of segment creation, onboarding and distribution using technology enablers such as Google Cloud Platform, Adobe RT-CDP, LiveRamp, and various media platforms.

Technologies in use: SQL, Adobe Campaign Standard, Adobe Real-Time Customer Data Platform, LiveRamp

ACCOUNTANT

Pittsburgh, PA

The Account works within the financial reporting / general accounting department. Reporting to the Manager of Financial Reporting, the position assists directly in the execution of the Company’s external and statutory reporting requirements as well as the month-end financial statement closing process. This position is responsible for performing day-to-day internal / external reporting and general accounting activities requiring a general understanding of business processes and the ability to investigate and explain variances in business results from period to period. Preparation of internal and external financial statements. Monthly general ledger close process, including journal entry preparation, account reconciliation and variance analysis to ensure conformity with US GAAP. Financial analysis, including direct involvement in the forecast / budgeting process. Assist in Company compliance with Sarbanes-Oxley internal control processes and documentation. Assist in certain other company financial statements and filings, including those related to retirement plans and the Company’s annual proxy statement. Ad-hoc projects as necessary; act as a liaison with external auditors.

Technologies in use: Microsoft Outlook, Word and Excel, ERP general ledger, PeopleSoft, Workiva Wdesk

What does the Executive Compensation model look like at DICK's?

Would you like to see more excerpts and highlights from DICK's Proxy Statement? Download the DICK's Sporting Goods Org Chart & Sales Intelligence Report.

More on Dick’s Sporting Goods

Dick’s Sporting Goods Contact InformationDick’s Sporting Goods Org Charts on Board of Directors, Executive Team, Marketing, Merchandising, Finance, HR, Supply Chain, Technology, etc.

Dick’s Sporting Goods Financial Insights

Dick’s Sporting Goods SWOT Report

Dick’s Sporting Goods PESTLE Report

Dick’s Sporting Goods Technographics

Dick’s Sporting Goods IT Budgets

Dick’s Sporting Goods Social Media Profiles

Dick’s Sporting Goods Actionable Sales Triggers Events

Email us and ask to see a sneak peek of the Dick’s Sporting Goods Org Charts & Sales Intelligence Report. Send us an email at info@databahn.com