We profile Marsh's structure, priorities, and sourcing motion, and provide concrete sales guidance. We identify key IT and procurement decision makers, including the global CIO/COO and CPO, and explain how Global Sourcing, MarshTech, and third‑party risk functions shape technology evaluations. We outline Marsh’s supplier activation, P2P, and cyber‑risk processes, and highlight recent AI, data, and digital initiatives (Databricks core, LenAI, Mercer AI platforms, BCS, P2P optimization) as signals of where pilots and “RFP‑like” evaluations are happening.

Databahn researched some of the major billion‑dollar+ acquisitions announced in the past 60–90 days (mid‑November 2025 through late January 2026). These are all multi‑billion‑dollar deals that were announced (not just closed) in that window. The blog post outlines the potential sales opportunities and sales approaches.

SoftBank’s agreement to acquire DigitalBridge for about $4 billion is a classic “picks and shovels” bet on the infrastructure behind the AI boom, combining SoftBank’s capital and AI thesis with DigitalBridge’s global data‑center and digital‑infrastructure platform. DigitalBridge expected to continue operating as a separately managed platform under its current CEO, Marc Ganzi.

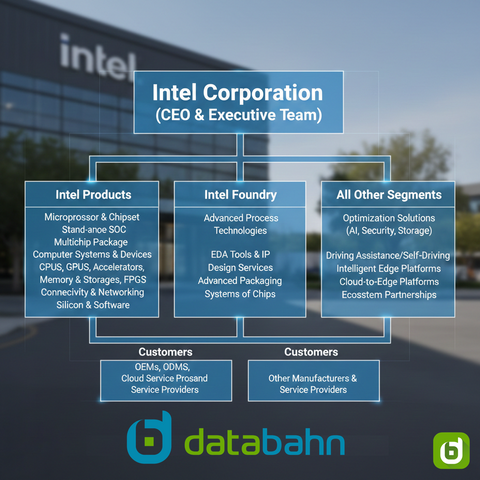

In a significant leadership move that signals Intel's deepening commitment to internal renewal, the company announced on November 18, 2025, the appointment of Cynthia "Cindy" Stoddard as senior vice president and chief information officer. Effective December 1, Stoddard stepped into a role that has grown increasingly pivotal amid Intel's broader efforts to modernize its operations and reclaim momentum in a fiercely competitive semiconductor landscape.

Omnicom’s acquisition of IPG creates the world’s largest advertising holding company, reshaping the competitive landscape around “scale, data, and AI-driven marketing.” The all‑stock transaction was first announced in December 2024 and closed on November 26, 2025, at a final equity value of $9 billion in Omnicom shares for IPG. Read the sales intelligence blog post for actionable insights and sales opportunities.

The Walmart CEO transition will officially occur on February 1, 2026. Doug McMillon will retire as CEO on January 31, 2026, and remain on Walmart’s Board of Directors through the next annual shareholders’ meeting to support a smooth transition to the new CEO, John Furner. How will this affect the organizational structure and their investments in technology? Read the full blog post for the details.

Citigroup is in the midst of one of the most significant leadership and structural transformations in its history, highlighted by the appointment of Gonzalo Luchetti as incoming CFO and the sweeping reorganization of its consumer divisions. The moves reflect an aggressive commitment to efficiency, transparency, and competitive growth, signaling a new era for the firm’s clients, investors, and workforce.

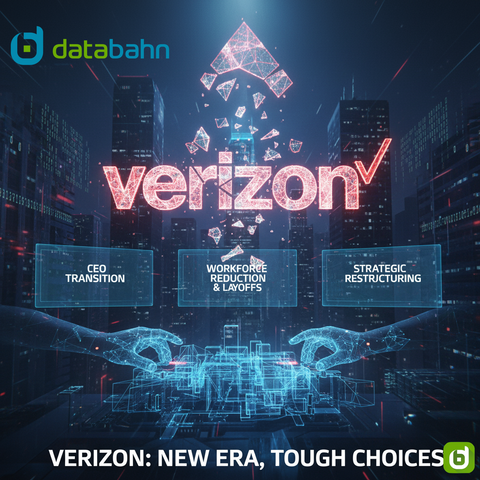

Verizon (Fortune Rank #30) is undergoing a major transformation as new CEO Daniel Schulman takes the helm, replacing Hans Vestberg amid intense market competition and declining subscriber growth. With Schulman’s aggressive restructuring plan—including up to 15,000 layoffs and renewed focus on customer value, operational efficiency, and technology investments—Verizon is poised for a pivotal shift in strategy as it aims to reclaim market leadership in the dynamic telecommunications sector.