Mastercard Org Chart & Sales Intelligence Blog

2000 Purchase Street

Purchase, NY 10577

United States

Main Phone: (914) 249-2000

Website: http://www.mastercard.com

Mastercard Org Chart Blog Highlights

Mastercard Incorporated (NYSE: MA) is ranked #191 on the 2020 Fortune 500 list

- Mastercard Launches Central Bank Digital Currencies (CBDCs) Testing Platform

- Highlights from CEO-elect Michael Miebach's presentation at the Virtual Deutsche Bank Technology Conference

- Mastercard Expands Installment Offerings Through Global Partnerships

Mastercard Org Charts

Mastercard Social Media properties

Facebook: https://www.facebook.com/MastercardUS/?brand_redir=1

LinkedIn: https://www.linkedin.com/company/mastercard/

Twitter: https://twitter.com/mastercardnews

YouTube: https://www.youtube.com/user/MasterCard

Mastercard Sales Trigger Events

Mastercard Partners With Usio to Boost City Possible Network

Mastercard Incorporated's MA City Possible recently partnered with Usio, Inc. USIO, which is best known for offering integrated electronic payment solutions. The tie-up has paved the way for continuous integration of Usio’s prepaid platform into the City Possible network. Notably, shares of Mastercard have lost 1.2% on Sep 18, replicating the declines in the broader markets.

It is to be noted that collaboration forms the crux of the City Possible network, where members work closely with each other for promoting sustainable urban development. The latest move clearly highlights Mastercard’s efforts to expand the reach of its City Possible network, which along with Accelerator for America has enabled Usio to engage in accelerated deployment of its innovative prepaid card solutions to several organizations across the United States.

Source: https://finance.yahoo.com/news/mastercard-partners-usio-boost-city-135801199.html

Mastercard unites technology leaders to launch Tech for Good Partnership

Mastercard has joined forces with leading financial services and technology providers to launch the Tech for Good Partnership, a private sector agreement to accelerate digital and financial inclusion in the Latin America and Caribbean region.The Partners in its initial activities will focus on developing concrete initiatives in specific markets to expand essential financial services like disbursements of much-need financial aid, long-standing access to credit, and educational resources and tools to the millions of Latin Americans who are currently vulnerable. Over time, the Partners have plans to share best practices and initiative outcomes with a broader financial services industry for the betterment of the ecosystem, via organized virtual events, white papers, and publications, among others.

“Technology has the power to change the reality for the millions of individuals and businesses unprepared to meet today’s challenges. As the digital economy grows exponentially, the role of businesses must also grow to unite the best minds, resources and efforts with a singular focus: to build an inclusive economy in the region. This can be a game-changer for so many,” said Carlo Enrico, President, Mastercard Latin America and Caribbean.

Source: https://ibsintelligence.com/ibsi-news/mastercard-unites-technology-leaders-to-launch-tech-for-good-partnership/

There are dozens more actionable sales trigger events in the Mastercard Sales Intelligence Report. Please download the Mastercard profile report to see all 37 of them.

Mastercard presents at the Virtual Deutsche Bank Technology Conference

Sept 14, 2020

Comments from Michael Miebach, CEO-elect

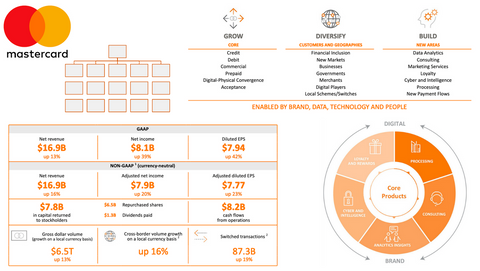

"The focus on digitization this is really where our groundwork over the last years has paid off to focus on tokenization our digital first approach et cetera, et cetera. So that is that we will continue down that route, our overall strategic focus around grow diversify build, we will not let off when it comes to focusing on our core business; diversifying into new geographies and customer segments. And that really where I spend most of my time in the last five years was the build part. That's multi rail, that's open banking; that is B2B, all that that's really where we have an opportunity with this digital tailwind to build this out."

"And then it's this look around open banking, basically of diversifying beyond payments into adjacent areas like data transactions and so forth. So, to keep that focus, we'll do that we'll do it organically."

"Across all of these trends, we're well invested, we're well positioned. And I said at the outset, our whole work around tokenization and gateway capabilities and so forth pays off right now, but it's also the time as you think about click to pay. Here's a great consumer experience making the online acceptance of -- for checkout experience, the guest experience so much easier. So we'll play right into that changing consumer behavior."

"On the data analytics side, again, there is quite a set of capabilities that are not linked to transaction growth or changes in the number of transactions. And that is our test to learn capability that is indeed, the most interesting asset on the data analytic side in a time of absolute crisis, every customer need a bank, be the merchant, be the government wanted to understand how this crisis is hitting my environment, my business, my industry, my country." - Source

Mastercard Earnings Call Highlights

July 30, 2020

Executives In Attendance

- Warren Kneeshaw – Executive Vice President of Investor Relations

- Ajay Banga – Chief Executive Officer

- Michael Miebach – President

- Sachin Mehra – Chief Financial Officer

- Tim Murphy – General Counsel

Analysts in Attendance

- Bryan Keane – Deutsche Bank

- Darrin Peller – Wolfe Research

- Craig Maurer – Autonomous Research

- Lisa Ellis – MoffettNathanson

- Bob Napoli – William Blair

- Tien-tsin Huang – JPMorgan

- Sanjay Sakhrani – KBW

- Andrew Jeffrey – SunTrust

- David Togut – Evercore ISI

- Ashwin Shirvaikar – Citi

- As part of Mastercard's $250 million commitment to support small business globally, Mastercard has developed the Digital Doors initiative, which provides gateway, cybersecurity and other resources for merchants to quickly establish an online presence and start accepting electronic payments.

- The Mastercard installment solution has been available market-wise for several years. The company's acquisition of Vyze allowed Mastercard to advance presence with marquee merchants in the U.S. And internationally, forging partnerships with Pine Labs, Afterpay to provide tailored regional solutions.

- Mastercard has engaged with governments in over 100 data analytics, cybersecurity and disbursement programs in over 30 markets around the world since the crisis began.

- The company's services capabilities provided key elements of differentiation to help win several deals this quarter. Mastercard key consumer partnerships with Bank in the U.S., Abu Dhabi Commercial Bank in UAE, Santander in Mexico and a credit renewal with the Bank of China.

Mastercard Q2 2020 Earnings Call on July 28, 2020

Mastercard Executive Leadership

| Ajay Banga | President and Chief Executive Officer |

| Ajay Bhalla | President, Cyber and Intelligence Solutions |

| Andrea Scerch | President, Consumer Products and Processing |

| Ann Cairns | Executive Vice Chairman |

| Ari Sarker | Co-President, Asia Pacific |

| Blake Rosenthal | Executive Vice President, Acceptance Solutions |

| Carlo Enrico | President, Latin America and Caribbean |

| Carlos Menendez | President, Enterprise Partnerships |

| Craig Vosburg | President, North America |

| Dimitrios Dosis | President, Advisors |

| Ed McLaughlin | President, Operations and Technology |

| Francis Hondal | President, Loyalty & Engagement |

| Gilberto Caldart | President, International |

| Hai Ling | Co-President, Asia Pacific |

| James Anderson | Executive Vice President, Commercial Products |

| Jennifer Rademaker | Executive Vice President, Customer Delivery |

| Jorn Lambert | Chief Digital Officer, Digital Consumer Solutions |

| Kevin Stanton | Chief Transformation Officer |

| Kush Saxena | Executive Vice President, U.S. Merchants and Acceptance |

| Linda Kirkpatrick | President, U.S. Issuers |

| Mark Barnett | President, Europe |

| Michael Fraccaro | Chief People Officer |

| Michael Froman | Vice Chairman and President, Strategic Growth |

| Michael Miebach | President and CEO-Elect |

| Paul Stoddart | President, New Payment Platforms |

| Raghu Malhotra | President, Middle East and Africa |

| Raj Seshadri | President, Data and Services |

| Raja Rajamannar | Chief Marketing & Communications Officer and President, Healthcare |

| Sachin Mehra | Chief Financial Officer |

| Tim Murphy | General Counsel |

Mastercard Board of Directors

| NAME | TITLE | COMPANY |

| Richard Haythornthwaite | Chairman and Co-founder | QiO Technologies |

| Ajay Banga | Chief Executive Officer | Mastercard Inc |

| Richard Davis | Chief Executive Officer | Make-A-Wish America |

| Steven J. Freiberg | Former CEO | ETrade Financial Corporation |

| Julius Genachowski | Managing Director and Partner | The Carlyle Group |

| Choon Phong Goh | Chief Executive Officer | Singapore Airlines Limited |

| Merit E. Janow | Dean, School of International & Public Affairs (SIPA) | Columbia University |

| Oki Matsumoto | Managing Director, Chairman and CEO | Monex Group, Inc. |

| Rima Qureshi | EVP and Chief Strategy Officer | Verizon Communications Inc. |

| José Octavio Reyes Lagunes | Former Vice Chairman, The Coca-Cola Export Corporation | The Coca-Cola Company |

| Youngme Moon | Donald K. David Professor of Business Administration | Harvard Business School |

| Gabrielle Sulzberger | General Partner | Fontis Partners, L.P. |

| Jackson Tai | Former Vice Chairman and CEO | DBS Group and DBS Bank Ltd. |

| Lance Uggla | Chairman and Chief Executive Officer | IHS Markit Ltd. |

Mastercard Annual Report Highlights

Mastercard is a technology company in the global payments industry that connects consumers, financial institutions, merchants, governments, digital partners, businesses and other organizations worldwide, enabling them to use electronic forms of payment instead of cash and checks. The company make payments easier and more efficient by providing a wide range of payment solutions and services using family of well-known brands, including Mastercard®, Maestro® and Cirrus®.

Mastercard Financial Highlights

| Fiscal Year | |

| Fiscal Year Ends | December 31, 2020 |

| Most Recent Quarter | July 30, 2020 |

| Profitability | |

| Profit Margin | 45.12% |

| Operating Margin | 55.49% |

| Management Effectiveness | |

| Return on Assets | 19.79% |

| Return on Equity | 125.61% |

| Income Statement | |

| Revenue | 16.23 Billion |

| Revenue Per Share | 16.1 |

| Quarterly Revenue Growth | -18.90% |

| Gross Profit | 16.88B |

| EBITDA | 9.58B |

| Net Income Avi to Common | 7.32B |

| Diluted EPS | 7.23 |

| Quarterly Earnings Growth | -30.70% |

| Balance Sheet | |

| Total Cash | 11.53B |

| Total Cash Per Share | 11.52 |

| Total Debt | 12.5B |

| Total Debt/Equity | 190.87 |

| Current Ratio | 1.95 |

| Book Value Per Share | 6.44 |

| Cash Flow Statement | |

| Operating Cash Flow | 8.65B |

| Levered Free Cash Flow | 6.87B |

Mastercard Strategy

Mastercard grows, diversifies and builds business through a combination of organic and inorganic strategic initiatives.

- personal consumption expenditure (“PCE”) growth

- driving cash and check transactions toward electronic forms of payment

- increasing share in the payments space

Growing the company's business also includes supplementing core network by providing integrated value-added products and services and enhanced payment capabilities to capture new payment flows, such as business to business (“B2B”), person to person (“P2P”), business to consumer (“B2C”) and government payments.

Mastercard Recent Developments

Click to Pay- delivered “click to pay”, activation of the EMV Secure Remote Commerce industry standard that enables a faster, more secure checkout experience across web and mobile sites, mobile apps and connected devices. This checkout experience is designed to provide consumers the same convenience and security in a digital environment that they have when paying in a store, make it easier for merchants to implement secure digital payments and provide issuers with improved fraud detection and prevention capability.

Commercial and B2B

Building on corporate T&E, fleet, purchasing card and small business capabilities, the company has been increasingly focused on developing solutions to address other ways that businesses move money.

- They announced Mastercard Track, B2B payment ecosystem which represents a collection of products and services aimed at improving the way businesses pay and get paid. The Track suite of products aims to introduce Mastercard Track Business Payment Service™, an open-loop commercial service built to simplify and automate payments between suppliers and buyers.

- They extended support for commercial cards by adding new partners to virtual card program, with a focus on helping to make virtual cards a preferred tool with straight-through (automated) acceptance and processing.

New payment flows

Other Initiatives

The company continued to implement the shift to a symbol brand by dropping the name from the logo, and debuted the sonic brand identity, comprised of a comprehensive sound architecture featuring a distinctive melody that will be employed in physical, digital and voice environments where consumers engage with Mastercard across the globe.

See the Full Mastercard 2019 Annual Report

More on Mastercard

- Mastercard Contact Info

- Mastercard Org Charts on Corporate Structure, Executive Leadership, Sales, Marketing, Finance, HR, Supply Chain, Technology, R&D, Manufacturing, etc

- Mastercard Financial Insights

- Mastercard SWOT Report

- Mastercard Technologies in Use

- Matercard IT Budgets

- Mastercard Social Media Profiles

- Mastercard Actionable Sales Trigger Events

About databahn

databahn builds customized deep dive account intelligence reports to help sellers and marketers eliminate costly research time and build pipeline opportunities. databahn focuses on large and complex Fortune 500, Fortune 1000, Global 2000, State Government, and Higher Education organizations. databahn's highly experienced research team is located in beautiful Nashua, New Hampshire. For more information, please email info@databahn.com