McDonald's Org Chart and Sales Intelligence Blog

McDonald's Corporation

110 North Carpenter Street

Chicago, IL 60607

United States

630 623 3000

http://corporate.mcdonalds.com

McDonald's Sales Intel Blog Highlights

McDonald's Corporation (NYSE: MCD) is ranked #156 on the 2020 Fortune 500 list

- McDonald’s Corp. expands probe of fired CEO Steve Easterbrook

- McDonald's Restaurants Anticipate Hiring Approximately 260,000 This Summer

- In June, McDonald's recovered nearly 90% of 2019 sales

McDonald's Org Charts

McDonald's Sales Trigger Events

McDonald’s U.S. Human Resources Leader Leaves Brand

In a recording of an online meeting accessed by the Journal, Global Chief Talent Officer Heidi Capozzi said, “for a variety of reasons, and unfortunately I can’t comment on the specifics, we determined that her separation was really in the best interest of the company.” McDonald’s is searching for Steinbach’s replacement.

Source: https://www.qsrmagazine.com/fast-food/mcdonalds-us-human-resources-leader-leaves-brand

McDonald's Makes a Series of Executive Changes

McDonald’s on Monday named Mason Smoot its U.S. chief restaurant officer as part of a series of executive changes at the Chicago-based burger giant.

Craig Brabec, Chief Data Analytics Officer has served a total 30 days in role.

Shammara Howell, Global Chief Talent Officer has served a total 4 months in role (4 years at McDonald’s).

Lucy Brady, Chief Digital Customer Engagement Officer has served less than 9 months in role (4 years at McDonald’s).

Source: https://www.restaurantbusinessonline.com/financing/mcdonalds-makes-some-executive-changes

McDonald's Social Media properties

Instagram: https://www.instagram.com/mcdonalds/

LinkedIn: https://www.linkedin.com/company/mcdonald%27s-corporation/

Twitter: https://twitter.com/McDonaldsCorp

YouTube: https://www.youtube.com/user/McDonaldsUS

McDonald's Earnings Call Highlights

July 28, 2020

Executives In Attendance

- Mike Cieplak - IR Officer

- Chris Kempczinski - President & CEO

- Kevin Ozan - CFO

Analysts in Attendance

- Andrew Charles - Cowen

- David Tarantino - Baird

- John Glass - Morgan Stanley

- Jon Tower - Wells Fargo

- David Palmer - Evercore

- Sara Senatore - Bernstein

- Andrew Strelzik - BMO

- Chris O'Cull - Stifel

- Jeff Bernstein - Barclays

- John Ivankoe - JP Morgan

- Chris Carril - RBC

- Matt DiFrisco - Guggenheim

- Peter Saleh - BTIG

- Drive-thru times have also improved across most major markets averaging 15 to 20 seconds of improvement. Across the company's big five IOM markets: Australia, Canada, France, Germany and the UK, about 70% of restaurants offer drive-thru. And this safe and convenient service channel has been particularly appealing to customers during the pandemic. McDonald's has seen a significant increase in drive-thru sales in these markets during COVID.

- McDonald's amassed a sizable marketing war chest to invest in the back half of 2020. During Q2 most major markets significantly reduced their marketing spend and value activities. As an example in the U.S., marketing spend was down 70%, as the company chose to conserve resources until the situation stabilized. These funds will now be reinvested in Q3 and Q4. Additionally, as previously announced, McDonald's will also invest an incremental $200 million in marketing spend across U.S. and International Operated Markets in the second half to accelerate recovery, roughly equivalent to one additional month of media in every owned market. Together, these actions will result in a sizeable increase in marketing spend for the balance of the year.

- McDonald's entered the quarter with about 75% of restaurants open.

While in June, McDonald's recovered nearly 90% of 2019 sales. Performance across the markets is varied and uneven, depending on external factors such as government restrictions, and consumer sentiment giving concerns of resurgence. For as long as the virus is present, this is the likely operating environment, especially as the company also considers government assistance to consumers rolling-off in many markets and general economic uncertainty, and well-positioned to navigate through at all.

McDonald's Q2 2020 Earnings Call on July 28, 2020: https://seekingalpha.com/article/4361392-mcdonalds-corporations-mcd-ceo-chris-kempczinski-on-q2-2020-results-earnings-call-transcript?part=single

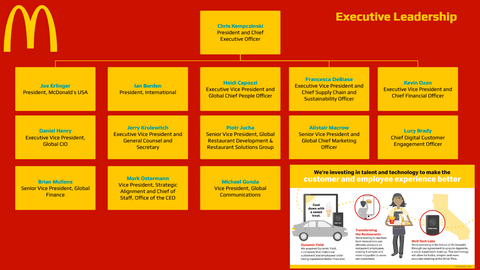

McDonald's Executive Leadership Team

| Chris Kempczinski | McDonald’s President and CEO |

| Charlie Strong | Zone President West, McDonald’s USA |

| David Tovar | Vice President, U.S. Communications |

| Joe Erlinger | President, McDonald’s USA |

| Mahrukh Hussain | General Counsel, McDonald’s USA |

| Mário Barbosa | Zone President East, McDonald’s USA |

| Marion Gross | Chief Supply Chain Officer, North America |

| Mason Smoot | Senior Vice President and Chief Restaurant Officer, McDonald’s USA |

| Michelle Borninkhof | CIO and Vice President, U.S. Technology |

| Morgan Flatley | Chief Marketing Officer, McDonald’s USA |

| Spero Droulias |

Chief Financial Officer, McDonald’s USA |

McDonald's Board of Directors

| NAME | TITLE | COMPANY |

| Enrique Hernandez, Jr. | Non-Executive Chairman | McDonald’s |

| Lloyd H. Dean | Chief Executive Officer | CommonSpirit Health |

| Robert A. Eckert | Operating Partner of Friedman | Fleischer & Lowe, LLC |

| Catherine M. Engelbert | Commissioner | Women’s NBA |

| Margaret H. Georgiadis | President and Chief Executive Officer | Ancestry |

| Chris Kempczinski | President and Chief Executive Officer | McDonald’s |

| Richard H. Lenny | Non-executive Chairman | Conagra Brands, Inc. |

| John J. Mulligan | Executive Vice President and Chief Operating Office | Target Corporation |

| Sheila A. Penrose | Non-executive Chairman | Jones Lang LaSalle Inc, |

| John W. Rogers, Jr. | Founder, Chairman of the Board and Co-CEO and Chief Investment Officer | Ariel Investments, LLC |

| Paul S. Walsh | Chairman | Compass Group PLC |

| Miles D. White | Executive Chairman | Abbott Laboratories |

| Andrew J. McKenna | Chairman Emeritus | McDonald’s Corporation |

McDonald's Annual Report Highlights

McDonald's 2019 Annual Report filed for Fiscal Year-End December 31, 2019

Effective January 1, 2019, McDonald's operates under an organizational structure designed to support the Company's efforts toward efficiently driving growth through the Velocity Growth Plan (the "Plan"). The Company’s reporting segments are aligned with its strategic priorities and reflect how management reviews and evaluates operating performance. Significant reportable segments include the United States ("U.S.") and International Operated Markets.

The Company franchises and operates McDonald’s restaurants, which serve a locally-relevant menu of quality food and beverages in 119 countries. Of the 38,695 restaurants at year-end 2019, 36,059 were franchised, which is 93% of McDonald's restaurants.

McDonald's Financial Highlights

| Fiscal Year | |

| Fiscal Year Ends | December 31, 2020 |

| Most Recent Quarter | June 30, 2020 |

| Profitability | |

| Profit Margin | 24.95% |

| Operating Margin | 37.84% |

| Management Effectiveness | |

| Return on Assets | 9.41% |

| Return on Equity | N/A |

| Income Statement | |

| Revenue | $19.12 Billion |

| Revenue Per Share | 25.54 |

| Quarterly Revenue Growth | -30.50% |

| Gross Profit | 11.12B |

| EBITDA | 8.91B |

| Net Income Avi to Common | 4.77B |

| Diluted EPS | 6.33 |

| Quarterly Earnings Growth | -68.10% |

| Balance Sheet | |

| Total Cash | 3.26B |

| Total Cash Per Share | 4.38 |

| Total Debt | 51.92B |

| Total Debt/Equity | N/A |

| Current Ratio | 0.91 |

| Book Value Per Share | -12.72 |

| Cash Flow Statement | |

| Operating Cash Flow | 5.51B |

| Levered Free Cash Flow | 2.92B |

McDonald's 2019 Financial Performance

In 2019, global comparable sales increased 5.9% and global comparable guest counts increased 1.0%, reflecting the continued execution against the Velocity Growth Plan.

- Comparable sales in the U.S. increased 5.0% and comparable guest counts decreased 1.9%. The increase in comparable sales reflected strong sales of our iconic core products driven by promotional activity and the continued positive impact from our Experience of the Future ("EOTF") deployment, as well as menu price increases.

- Comparable sales in the International Operated segment increased 6.1% and comparable guest counts increased 3.5%, reflecting positive results across all markets, primarily driven by the U.K. and France.

- Comparable sales in the International Developmental Licensed segment increased 7.2% and comparable guest counts increased 2.2%, reflecting positive sales performance across all geographic regions.

McDonald's Strategic Direction

The Velocity Growth Plan, the Company’s customer-centric strategy, is rooted in extensive customer research and insights, along with a deep understanding of the key drivers of the business. The Plan is designed to drive sustainable comparable sales and guest count growth, reliable long-term measures of the Company's strength that are vital to growing shareholder value. In 2019, execution of the Plan drove further broad-based growth around the globe.

In 2020, the Company will continue to focus on elevating the customer experience through improved restaurant execution and creating excitement around our food and value offerings, while continuing to leverage technology to

enable greater convenience and customer personalization.

The Company continues to target the opportunity at the core of its business - its food, value and customer experience. The strategy is built on the following three pillars, all focusing on building a better McDonald’s:

- Retaining existing customers - focusing on areas where it already has a strong foothold in the IEO category, including family occasions and food-led breakfast.

- Regaining customers who visit less often - recommitting to areas of historic strength, namely food taste and quality, convenience and speed, experience and value.

- Converting casual to committed customers - building stronger relationships with customers so they visit more often, by elevating and leveraging the McCafé coffee brand and enhancing snack and treat offerings.

The Company continues to scale and optimize the Plan through the following growth accelerators:

- Experience of the Future. The Company is building upon its investments in EOTF, focusing on restaurant modernization in order to transform the restaurant service experience and enhance our brand in the eyes of our customers. In 2020, the Company will further deploy EOTF around the globe, including converting about 1,800 of the remaining restaurants in the U.S. to EOTF.

- Digital. The Company is improving its existing service model with customers through technology. Digital technology is transforming the retail industry, and the Company is using it to transform McDonald’s for our customers at an accelerated pace. In 2019, the Company built on its digital foundation, acquiring Dynamic Yield, a leader in personalization and decision logic technology. The Company has implemented this technology via outdoor digital menu boards in over 11,000 U.S. drivethrus, offering customers a more customized experience and producing sales growth through higher average check.

- Delivery. The Company continues to build momentum with its delivery platform as a way of expanding the convenience for its customers. In 2019, McDonald’s continued to add third-party delivery partners in order to maximize the System’s delivery scale and potential.

See the Full McDonald's 2019 Annual Report

More on McDonald's

- McDonald's Contact Info

- McDonald's Org Charts on Corporate Structure, Executive Leadership, Sales, Marketing, Finance, HR, Supply Chain, Technology, R&D, Manufacturing, etc.

- McDonald's Financial Insights

- McDonald's SWOT Report

- McDonald's Technologies in Use

- McDonald's IT Budgets

- McDonald's Social Media Profiles

- McDonald's Actionable Sales Trigger Events

About databahn

databahn builds customized deep dive account intelligence reports to help sellers and marketers eliminate costly research time and build pipeline opportunities. databahn focuses on large and complex Fortune 500, Fortune 1000, Global 2000, State Government, and Higher Education organizations. databahn's highly experienced research team is located in beautiful Nashua, New Hampshire. For more information, please email info@databahn.com